| Home -> James H. Barry Press -> The Great Diamond Hoax - Chapter XXXVIII | |||

|

Chapter XXXVIII.

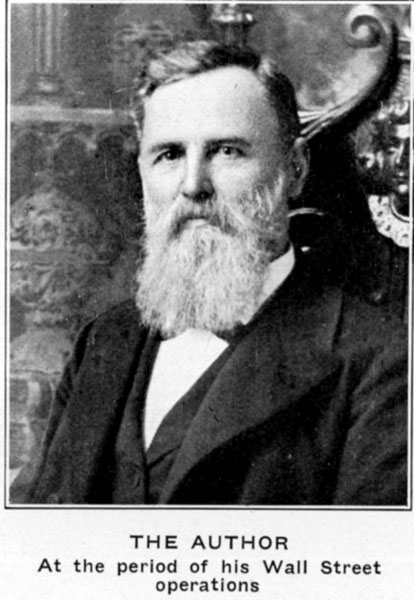

Author Tries Luck in Wall Street and Makes Big Fortune, Only to Lose it in Mining Investments. Silver Falls and Land Slides, But Disaster Fails to Discourage Man Who Has Outlived Old Associates. All the various people of the story have been accounted for and decently retired. Before the curtain falls I have just a word to say about myself to those who have followed the narrative of sixteen tempestuous years from 1857 to 1873. The role of a Kentucky country gentleman was not to my liking. As I have said, I sold out everything and retired from California after the bursting of the diamond bubble. I resolved that nothing should tempt me again into an active career. But the lure of the busy world was more potent than I realized. After a few years of the simple life I made my headquarters in New York, studied and grasped the investment and speculative markets, and became one of the recognized figures of Wall Street. Good fortune, as a rule, attended my ventures. Sometimes the tide turned the other way, but I think, taking one year with another, each saw my assets materially increased. At one time I was worth very near if not quite four million dollars, which is distinctly more than any man ought to have. But when one is fairly gone in the money-making intoxication he never knows when to stop, any more than the victim of alcohol. When I was at the zenith of my good luck I was induced to invest in two mining properties in the United States of Columbia, South America. One was an immense silver mining district, the other a great hydraulic proposition with almost fabulous gold-hearing gravel resources. Both were passed upon favorably by the ablest experts that money could hire. The reports were justified by the facts, yet both projects ended in ruinous disaster to me. I was drawn into a much larger investment than I contemplated. As I developed the silver property, the economy of a much larger plant and the ownership of adjacent mineral territory became self-evident. There appeared no element of risk. Silver, after various fluctuations, seemed to have reached a firm level. Financial experts were in accord that the price of the white metal could not possibly go lower, was much more likely to advance than to recede. Even with silver at 80 cents an ounce, the profits on my mining operations would be enormous. I figured to clear such profits that in a few years I would receive back my capital investment and own a property with an earning capacity of millions. In fact, during the period of practical operation these estimates were fully borne out. Then something happened. Without a note of warning to the commercial world, Great Britain closed the mints of India to the coinage of silver. As long as this The hydraulic mining project fared no better. The gold gravel deposit appeared humanly inexhaustible. All the physical conditions seemed favorable. Water had to be brought in a ditch for twenty-three miles. Most of the ditch, carrying 10,000 miner's inches of water, was completed. Then something happened again. For nearly a mile at its upper end the line of the ditch ran along a rather steel) hillside of shale foundation. When the surface was broken, the whole mountain seemed to get in motion. Millions of tons slid down, bringing to naught every effort of our engineers. Money, as a rule, will in the end conquer every physical obstacle. But about this time a third thing happened, most serious of all my funds ran so low that to continue the enterprise further meant an invitation to a final and complete disaster. My fortune was not lost. It is still intact, buried in the mountains of the United States of Colombia. I have no doubt that some adventurous speculator of the future, under happier conditions, will dig it out. Since then I have been a miner and dealer in mining properties, with the common average of the miner's ups and downs. Much of my time has been devoted to the mother lode of California, where I own a property that has an immense future. I am an old man now-in years, but not in hope. I have outlived not alone nearly all my contemporaries, covered by this narrative, but the turbulence and ardor of my early years as well. But while many illusions inseparable from the imagination of a robust and enterprising youth have disappeared, I still have very definite ambitions to pull off one more surprise on the world before the close. There may yet be a sequel, another chapter to the story to which may be attached more fittingly than now the sad word that marks the conclusions of all things human (The End.) [The above was written nearly two years ago. Since then Mr. Harpending's ambition has been realized. He sold one of his mines on the Mother Lode and after many fluctuations of fortune is again the possessor of ample means. One of his last and best friends was John A. Finch, of Spokane, to whom this volume is dedicated. Just as the forms were going to press, word came of the sudden death of this good gentleman in Idaho. He took great interest in the publication of this book, which he can never read. - Editor.] |

|||

The Author At the period of his Wall Street operations. |

|||

The Late John A. Finch Who possessed all the qualities of a good man and many of the qualities of a great man. |

|||