| Home -> Academy of Pacific Coast History -> The San Francisco Clearing House Certificates of 1907-1908 -> Text | |

| Publications of the Academy of Pacific Coast History Vol. 1 No. 1 The San Francisco Clearing House Certificates of 1907-1908 By Carl Copping Plehn Professor of Finance, University of California University of California Berkeley, California January, 1909 Copyright, 1908, By The Academy of Pacific Coast History. Berkeley: The University Press |

|

|

|

|

|

|

|

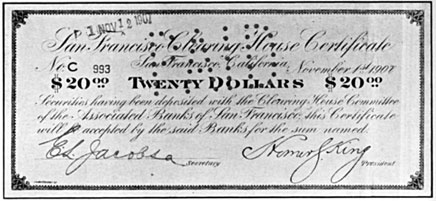

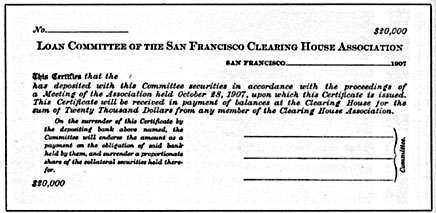

| The San Francisco Clearing House Certificates of 1907-1908 NOTE. - Through the courtesy of the San Francisco Clearing House, six complete specimen sets (cancelled) of the various forms and denominations of the Clearing House Certificates used in San Francisco during the recent financial stringency have been placed in the library of the Academy of Pacific Coast History, where they will be preserved for future reference. This memorandum is written to accompany the deposit and to provide a permanent record, for historical purposes, of the origin and use of the certificates and of the events of this interesting episode. In October, 1907, the banks in San Francisco experienced great difficulty in securing coin to supply the needs of the community for circulation. This stringency was San Francisco's participation in the general stringency felt all over the United States, and, as it had no local origin or local peculiarities, need not be reviewed in this connection. Two means of meeting this stringency and of avoiding dangerous results were applied. One was the device of "legal" and "special" holidays, declared by the Governor from day to day. The first "legal" holiday was October 31st, 1907, and the last was November 30th, 1907; these were declared under an old provision of the Political Code which empowers the Governor to declare any day a legal holiday. As these legal holidays interfered with certain proceedings of the courts and with business other than banking and finance, the legislature was called in special session, one of the main purposes of which was to devise a special kind of holiday which would apply only to the classes of business transactions affected by the stringency. The "special" holidays declared under the new statute began December 2nd, 1907 (December 1st having fallen on a Sunday) and the last one was December 21st, 1907. As to the exact legal effect of these holidays, "legal" and "special," there seems to be more or less question, and some litigation thereover is now before the courts. The practical effect, however, was to create a general impression in the minds of bank depositors and with the public, that the banks could not be compelled to do business. This had been the opinion generally held as to the holidays after the great fire in San Francisco. Entrenched behind this view of the effect of the holidays and using them as an excuse, the banks throughout California, while open for business as usual, were enabled to stave off demands which might otherwise have embarrassed them or have depleted their reserves. The other device was the issue of Clearing House certificates, both for use between the banks and for the use of the public generally. The latter use of this device presented peculiar difficulties in California, because the people are not accustomed to any kind of paper money. The first step in this direction was the issuance of so-called "Loan Certificates" in large denominations ($1,000, $2,000. $3,000, $4,000, $5,000, $10,000 and $20,000) for use between the banks and in making settlements through the Clearing House. The plan under which these were issued was practically identical with that under which similar certificates have been issued in New York and other cities during periods of stringency. The first of these certificates were issued October 29th, 1907, under the following agreement: For the purpose of enabling the banks, members of the San Francisco Clearing House Association, to afford proper assistance to the business community, and also to facilitate inter-bank settlements resulting from the daily exchanges, we, the undersigned, do bind ourselves by the following agreement on the part of the respective banks, namely: First - That a Clearing House Loan Committee of three, to be appointed for the purpose, be and it is hereby authorized to issue to any bank member of the Association, loan certificates bearing eight per cent. interest, on the deposit of bills receivable and other securities to such an amount and to such percentage thereof as may in its judgment be advisable. Provided that, in no case, shall certificates be issued for a greater amount than seventy-five per cent. of the market value of such securities; such market value to be determined by said Committee. These certificates may be used in settlement of balances at the Clearing House and they shall be received by creditor banks in the same proportion as they bear to the aggregate amount of the debtor balances paid at the Clearing House. The interest that shall accrue on such certificates shall be apportioned monthly among the banks which may have held them during that period; the Committee to have the right, however, to apportion such interest at more frequent intervals. Second - That the securities deposited with the said Committee shall be held in trust by it as a special deposit, pledged for the redemption of the certificates issued thereon, the same being accepted by the Committee as collateral security, with the express condition that neither the Clearing House Association, the Clearing House Loan Committee, nor any member thereof, shall be responsible for any loss on said collaterals, arising from failure to make demand or protest, or from any other neglect or omission concerning same, other than the refusal to take some reasonable step which the said depositing bank may have previously required in writing, and which step the Committee may deem to be fairly reasonable. Third - That on the surrender of said certificates, or any of them by the depositing bank, the Committee will endorse the amount as a payment on the obligation of said bank, held by them, and will surrender a proportionate amount of securities, the character whereof shall be determined by the Committee, except in cases of default of the bank in any of its transactions through the Clearing House, in which case the securities will be applied by the Committee: first, to the payment of outstanding certificates with interest; next, to the liquidation of any indebtedness of such bank to the other banks, members of the Clearing House Association, and any expenses connected with the same. Fourth - That the Committee shall be authorized to exchange any portion of said securities for others, to be approved by it, and shall have power to demand additional securities from the banks depositing same, at its own discretion. Fifth - That the Clearing House Loan Committee shall be authorized to carry into full effect this agreement, with power to establish such rules and regulations for the practical working thereof as they may deem necessary, and any loss caused by the non-payment of loan certificates and all expenses incurred in carrying out this agreement, shall be assessed by the Committee upon all the banks in the ratio of the average daily amount which each bank shall have sent to the Clearing House during the preceding calendar year. Sixth - That the Clearing House Loan Committee be and they are hereby authorized to terminate this agreement, upon giving thirty days' notice thereof to all the banks, members of the San Francisco Clearing House Association. Seventh - That, upon the deposit of securities with the Clearing House Loan Committee and the receipt of loan certificates therefor, such bank shall execute and deliver an obligation in the following form: The ............................. Bank has this day received of the Clearing House Loan Committee of the San Francisco Clearing House Association loan certificates issued by said Committee in pursuance of an agreement of the members of said Association, passed ............................. (which is made part hereof) to the amount of ............................. thousand dollars and has deposited with said Committee the securities, a statement whereof is hereto annexed; and said ............................. Bank has received said loan certificates on the terms set forth in said agreement, and agrees to pay the amount of said certificates with interest thereon, as provided in said agreement and in said certificates. Eighth - That statements shall be made to the Clearing House Loan Committee of the condition of each bank, on the morning of each day, before the commencement of business, which shall be sent to the Chairman of the Clearing House Loan Committee, specifying the following items, namely: 1. Loans and discounts. 2. Bonds and securities. 3. Balances with other banks, subject to check. 4. Money on hand. 5. Deposits. 6. Loan certificates. Ninth - This agreement shall be duly and regularly authorized and ratified by the respective banks belonging to the San Francisco Clearing House Association, and a certified copy of such authorization and ratification be delivered to the Chairman of the Clearing House Loan Committee. The following is a photographic reproduction of one of the "Loan Certificates"; the text was the same for all the different denominations: |

|

|

|

| The maximum issue of "Loan Certificates" occurred on December 24, 1907, when the amount outstanding was $12,339,000. Although the agreement as cited above permitted the issue of certificates up to 75 per cent. of the appraised value of the bills receivable and securities deposited, the Committee did not in general authorize issues beyond from 50 per cent. to 60 per cent. of what it considered the sound value of the security offered. The following table shows the issuance and redemptions of these, certificates by weeks: |

|

| Weekly Statement of the Issues and Redemptions of Loan Certificates. | |||||||

| Loan Certificates Issued. | |||||||

| Week ending | $1,000 | $2,000 | $3,000 | $5,000 | $10,000 | $20,000 | Totals |

| Nov. 6, 1907 | $269,000 | $388,000 | $240,000 | $1,510,000 | $2,110,000 | $1,560,000 | $6,077,000 |

| 12, 1907 | 190,000 | 308,000 | 240,000 | 670,000 | 790,000 | 280,000 | 2,478,000 |

| 19, 1907 | 55,000 | 40,000 | 165,000 | 365,000 | 580,000 | 420,000 | 1,625,000 |

| 26, 1907 | 20,000 | 50,000 | 45,000 | 120,000 | 100,000 | 860,000 | 1,195,000 |

| Dec. 5, 1907 | 20,000 | 60,000 | 150,000 | 200,000 | 430,000 | ||

| 12, 1907 | 20,000 | 30,000 | 50,000 | 300,000 | 400,000 | ||

| 19, 1907 | 30,000 | 100,000 | 240,000 | 370,000 | |||

| 26, 1907 | 50,000 | 110,000 | 180,000 | 340,000 | |||

| Feb. 29, 1908 | 45,000 | 80,000 | 125,000 | ||||

| $574,000 | $786,000 | $690,000 | $2,880,000 | $3,990,000 | $4,120,000 | $13,040,000 | |

| Loan Certificates Redeemed. | |||||||

| Week ending | $1,000 | $2,000 | $3,000 | $5,000 | $10,000 | $20,000 | Totals |

| Nov. 29, 1907 | $4,000 | $6,000 | $180,000 | $130,000 | $40,000 | $360,000 | |

| Dec. 6, 1907 | 2,000 | 6,000 | 10,000 | 10,000 | 60,000 | 88,000 | |

| 13, 1907 | 1,000 | 8,000 | $3,000 | 10,000 | 80,000 | 102,000 | |

| 20, 1907 | 5,000 | 20,000 | 25,000 | ||||

| 27, 1907 | 1,000 | 90,000 | 100,000 | 191,000 | |||

| Jan. 3, 1908 | 4,000 | 12,000 | 9,000 | 15,000 | 10,000 | 260,000 | 310,000 |

| 10, 1908 | 14,000 | 4,000 | 3,000 | 120,000 | 200,000 | 100,000 | 441,000 |

| 17, 1909 | 19,000 | 20,000 | 6,000 | 20,000 | 500,000 | 1,140,000 | 1,705,000 |

| 24, 1908 | 234,000 | 394,000 | 327,000 | 1,055,000 | 1,370,000 | 1,540,000 | 4,920,000 |

| 31, 1908 | 116,000 | 108,000 | 147,000 | 435,000 | 450,000 | 280,000 | 1,536,000 |

| Feb. 7, 1908 | 43,000 | 160,000 | 105,000 | 20,000 | 120,000 | 448,000 | |

| 14, 1908 | 29,000 | 130,000 | 300,000 | 220,000 | 679,000 | ||

| 21, 1908 | 29,000 | 10,000 | 111,000 | 250,000 | 570,000 | 100,000 | 1,070,000 |

| 28, 1908 | 330,000 | 70,000 | 40,000 | 440,000 | |||

| Mar. 5, 1908 | 61,000 | 56,000 | 78,000 | 85,000 | 130,000 | 410,000 | |

| 12, 1908 | 4,000 | 30,000 | 120,000 | 154,000 | |||

| 19, 1908 | 4,000 | 6,000 | 5,000 | 15,000 | |||

| 26, 1908 | 20,000 | 20,000 | |||||

| Apr. 7, 1908 | 2,000 | 2,000 | 4,000 | ||||

| 10, 1908 | 7,000 | 60,000 | 40,000 | 107,000 | |||

| $574,000 | $786,000 | $690,000 | $2,865,000 | $3,990,000 | $4,120,000 | $13,025,000 | |

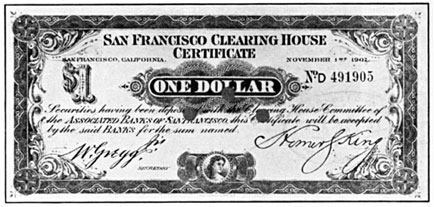

| To supply the need for an additional circulating medium in the hands of the public, scrip, consisting of Clearing House certificates of smaller denominations, was issued. In many respects this was a new departure in the functions of the Clearing House. The first of these certificates designated in the accompanying tables as "old issue" were in denominations of $5, $10, and $20. (See Fig. 1, frontispiece.) They were first issued November 4, 1907, and, having been hurriedly prepared to meet an emergency, were without protective design in engraving, although printed on "protected" paper. A total of $1,980,320 of these was issued. These were replaced a week later by a new issue in denominations of $1, $2, $5, $10, and $20. The new issue was protected on back as well as front with elaborate engraving. (See Fig. 2, frontispiece.) Banks desiring this scrip deposited the interest bearing "loan certificates," above described, with the Clearing House Committee. Upon the return of the scrip or circulating certificates to the Committee the banks withdrew an equivalent amount of loan certificates which they could then present, if they so desired, for return of the original securities. Until that was done the interest charge continued. These smaller certificates were first authorized under the following resolution passed by the Clearing House Association November 1, 1907: Resolved, That the Loan Committee be authorized to issue to members of the Clearing House, Clearing House Certificates of Deposit in denominations of $100 and less to a total amount of $2,500,000 at such times as it may deem necessary; that such certificates of deposit shall be secured by the pledge of Loan Certificates issued under resolutions of the Clearing House adopted October 28) 1907; that same shall be signed by one facsimile and one written signature and that the issue shall be under such regulations as the Loan Committee may prescribe. At a meeting of the same body held November 6, 1907, the following amendment to the resolution was passed: Resolved, That the resolution adopted by the Clearing House Association at its meeting held November 1, 1907, authorizing the Clearing House Loan Committee to provide for the issue of Clearing House Certificates of Deposit be amended by removing the limit of $2,500,000 on same. And further Resolved, That should the Clearing House Loan Committee in its discretion provide for the issue of Clearing House Certificates of Deposit in denominations of One Dollar and Two Dollars, such One Dollar and Two Dollar Certificates of Deposit shall only be signed in facsimile by the President and Secretary of the Clearing House Association. No interest was charged directly on the circulating scrip, or certificates of smaller denominations; but to procure such scrip the several banks had to deposit Clearing House loan certificates with the Clearing House Loan Committee. The loan certificates so deposited continued, of course, to bear interest in favor of their holder; in this case in favor of the committee. The loan certificates and the circulating scrip were immediately convertible through the Loan Committee, one into the other, both ways. As the bank depositing loan certificates for scrip lost the interest it would otherwise have received on the loan certificates, there was a strong inducement for it to withdraw the scrip from circulation as fast as possible and redeem an equivalent amount of loan certificates. This tended to contract the scrip, which, whenever it became in any degree redundant, was presented to the Loan Committee in exchange for loan certificates. The interest earned on the certificates in the hands of the Loan Committee was used to defray the expenses of the committee, which were very heavy. The balance of net profit was afterwards divided among the banks in proportion to the amount of their clearings, which in as much as the certificates were accepted in payment of balance through the Clearing House was the actual basis of their guarantee of the various issues; and not in accordance with the amount of use made of the Clearing House certificates. This indirect interest charge was the cause of the prompt retirement of the scrip. For as long as any bank had scrip outstanding it bore the 8 per cent. interest charge thereon, less only its proportion of the relatively small sub-profit made by the committee. Banks using little scrip profited most. A member of the Clearing House Loan Committee writes: "The plan worked beautifully, the circulating scrip being driven in rapidly after the greatest tension was over." It should be added that the general aversion of the public in California to any kind of paper money, even to bank notes, treasury notes, and gold certificates, or to "currency" as it is commonly called to distinguish it from "money" or gold and silver coin, aided greatly in the redemption of the scrip, which was returned to the banks as promptly as possible, together with other kinds of paper money which passed into circulation during the stringency. The connection of the "scrip" with the "loan certificates," involving as it did an indirect interest charge for the use of the "scrip," is a new feature in the history of Clearing House certificates. Somewhat similar "scrip" was issued in Seattle, Portland, and Tacoma, but without relation to the loan certificates or other provision for retirement or conversion. This failure to provide for conversion, in the cities just named, caused some embarrassment from which the San Francisco banks were free. It is reported that some banks in those cities became embarrassed by a plethora of scrip and a dearth of loan certificates while others suffered from the reverse condition. The smaller certificates circulated freely throughout, California, Nevada, and Southeastern Oregon, some reaching as far east as Philadelphia and some as far west as the Hawaiian Islands. It is reported that one was returned from Berlin and several from China for redemption. In all, both "old" and "new," $7,179,000 were issued. The following tables show the issues by weeks: |

| Old Issue Issued | ||||

| Week ending | $5.00 | $10.00 | $20.00 | Totals |

| Nov. 14, 1907 | $580,320 | $890,000 | $510,000 | $1,980,320 |

| Totals | $580,320 | $890,000 | $510,000 | $1,980,320 |

| Old Issue Redeemed | ||||

| Week ending | $5.00 | $10.00 | $20.00 | Totals |

| Nov. 14, 1907 | $173,280 | $283,540 | $147,820 | $604,640 |

| 21, 1907 | 79,000 | 145,000 | 81,500 | 305,500 |

| 27, 1907 | 69,500 | 93,000 | 52,000 | 214,500 |

| Dec. 5, 1907 | 55,000 | 73,500 | 44,000 | 172,500 |

| 12, 1907 | 53,000 | 71,000 | 45,000 | 169,000 |

| 19, 1907 | 26,000 | 38,000 | 26,000 | 90,000 |

| 26, 1907 | 15,500 | 25,000 | 10,000 | 50,500 |

| Jan. 2, 1908 | 23,000 | 29,500 | 21,000 | 73,500 |

| 9, 1908 | 42,000 | 53,000 | 31,000 | 126,000 |

| 16, 1908 | 16,500 | 29,000 | 16,500 | 62,000 |

| 23, 1908 | 9,500 | 15,500 | 14,000 | 39,000 |

| 30, 1908 | 4,960 | 10,010 | 4,200 | 19,170 |

| Feb. 6, 1908 | 3,770 | 6,940 | 4,740 | 15,450 |

| 13, 1908 | 3,270 | 7,170 | 3.700 | 14,140 |

| 20, 1908 | 2,575 | 4,020 | 3,640 | 10,235 |

| 27, 1908 | 815 | 1,340 | 700 | 2,855 |

| Mar. 5, 1908 | 415 | 1,320 | 760 | 2,495 |

| 12, 1908 | 205 | 880 | 240 | 1,325 |

| 19, 1908 | 400 | 430 | 200 | 1,030 |

| 26, 1908 | 235 | 330 | 260 | 825 |

| Apr. 3, 1908 | 190 | 330 | 60 | 580 |

| 7, 1908 | 35 | 10 | 40 | 85 |

| Totals | $579,150 | $888,820 | $507,360 | $1,975,330 |

| Outstanding | $1,170 | $1,180 | $2,640 | $4,990 |

| New Issue Issued | ||||||

| Week ending | $1.00 | $2.00 | $5.00 | $10.00 | $20.00 | Totals |

| Nov. 14, 1907 | $357,000 | $52,000 | $1,157,320 | $1,160,000 | $780,000 | $3,506,320 |

| 21, 1907 | 167,000 | 68,000 | 442,500 | 532,500 | 90,000 | 1,300,000 |

| 28, 1907 | 124,500 | 28,000 | 332,500 | 145,000 | 170,000 | 800,000 |

| Dec. 5, 1907 | 29,434 | 28,000 | 227,680 | 285,000 | 280,000 | 850,114 |

| 12, 1907 | 12,995 | 107,500 | 55,000 | 70,000 | 245,495 | |

| 19, 1907 | 32,500 | 25,500 | 15,000 | 73,000 | ||

| 26, 1907 | 2,500 | 2,500 | ||||

| Jan. 2, 1908 | 7,500 | 7,500 | ||||

| $690,929 | $176,000 | $2,310,000 | $2,203,000 | $1,405,000 | $6,784,929 | |

| New Issue Redeemed. | ||||||

| Week ending | $1.00 | $2.00 | $5.00 | $10.00 | $20.00 | Totals |

| Dec. 5, 1907 | $6,003 | $4,006 | $15 | $2,530 | $4,060 | $16,614 |

| 12, 1907 | $6,001 | 30,060 | 36,061 | |||

| 19, 1907 | 22,000 | 3,000 | 5,005 | 12,030 | 42,035 | |

| 26, 1907 | 53,100 | 9,400 | 65,000 | 77,000 | 44,000 | 248,500 |

| Jan. 2, 1908 | 89,400 | 23,000 | 400,000 | 370,000 | 154,000 | 1,036,400 |

| 9, 1908 | 152,200 | 38,800 | 700,500 | 661,500 | 407,000 | 1,960,000 |

| 16, 1909 | 210,900 | 58,600 | 540,000 | 451,000 | 312,000 | 1,572,500 |

| 23, 1908 | 69,700 | 17,800 | 270,000 | 274,500 | 185,000 | 817,000 |

| 30, 1908 | 30,619 | 7,648 | 116,410 | 122,660 | 100,060 | 377,397 |

| Feb. 6, 1908 | 12,900 | 3,300 | 67,250 | 77,500 | 61,000 | 221,950 |

| 13, 1908 | 11,089 | 3,820 | 43,000 | 58,240 | 52,460 | 168,609 |

| 20, 1908 | 7,846 | 2,578 | 25,150 | 29,910 | 25,400 | 90,884 |

| 27, 1908 | 2,761 | 1,062 | 11,900 | 15,440 | 12,560 | 43,723 |

| Mar. 5, 1908 | 1,764 | 616 | 9,310 | 11,370 | 12,480 | 35,540 |

| 12, 1908 | 1,123 | 310 | 5,385 | 7,890 | 7,440 | 22,148 |

| 19, 1908 | 1,069 | 374 | 3,475 | 4,820 | 3,400 | 13,138 |

| 26, 1908 | 720 | 156 | 3,305 | 6,020 | 3,960 | 14,161 |

| Apr. 3, 1908 | 1,538 | 412 | 1,925 | 4,490 | 4,760 | 13,125 |

| 7, 1908 | 123 | 22 | 745 | 520 | 840 | 2,250 |

| Totals | $680,856 | $174,904 | $2,298,435 | $2,187,420 | $1,390,420 | $6,732,035 |

| Outstanding | $10,073 | $1,096 | $11,565 | $15,580 | $14,580 | $52,894 |